Optimizing Operations: The Power of an Insurance Document Management System

The Importance of an Insurance Document Management System

Managing insurance documents efficiently is crucial for insurance companies to operate smoothly and effectively. An insurance document management system is a specialized software solution that helps streamline the storage, organization, and retrieval of important documents related to insurance policies, claims, customer information, and more.

Benefits of Using an Insurance Document Management System:

- Improved Efficiency: By digitizing and centralizing all insurance documents, employees can easily access the information they need without wasting time searching through paper files.

- Enhanced Security: These systems provide secure storage for sensitive documents, ensuring that only authorized personnel can view or modify them.

- Compliance Adherence: Insurance companies must comply with various regulations and standards. A document management system helps ensure that all necessary documentation is maintained and easily accessible for audits.

- Cost Savings: Going paperless reduces the costs associated with printing, storing, and managing physical documents.

- Better Customer Service: Quick access to customer information allows insurers to respond promptly to inquiries and process claims faster.

Key Features of an Insurance Document Management System:

An effective insurance document management system typically includes features such as:

- Document Capture: Scanning and uploading physical documents into the system.

- Indexing and Metadata Tagging: Adding searchable keywords and tags to facilitate document retrieval.

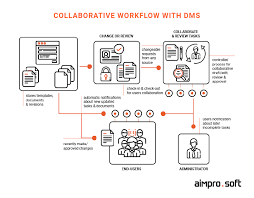

- Version Control: Tracking changes made to documents over time.

- Workflow Automation: Streamlining processes like approval workflows for faster document handling.

- Integration Capabilities: Connecting with other software systems used by the insurance company for seamless data exchange.

In conclusion, investing in an insurance document management system can significantly improve operational efficiency, data security, regulatory compliance, and customer service within an insurance organization. By leveraging modern technology to manage their documents effectively, insurers can stay competitive in a rapidly evolving industry.

Top 5 Benefits of an Insurance Document Management System: Efficiency, Security, Compliance, Cost Savings, and Enhanced Customer Service

- Improved efficiency in accessing and managing insurance documents.

- Enhanced security for sensitive information with restricted access.

- Facilitates compliance adherence by maintaining and organizing necessary documentation.

- Cost savings by reducing expenses related to printing and storing physical documents.

- Better customer service through quick retrieval of customer information for inquiries and claims processing.

Key Challenges of Implementing an Insurance Document Management System

Improved efficiency in accessing and managing insurance documents.

Improved efficiency in accessing and managing insurance documents is a key advantage of implementing an insurance document management system. By digitizing and centralizing all relevant documents, employees can quickly locate the information they need without the time-consuming task of sifting through physical files. This streamlined process not only saves valuable time but also enhances productivity by enabling staff to focus on core tasks rather than administrative document handling. Additionally, the ease of access to organized digital documents facilitates faster decision-making, smoother collaboration among team members, and ultimately leads to a more efficient workflow within the insurance company.

Enhanced security for sensitive information with restricted access.

Enhanced security for sensitive information with restricted access is a key advantage of an insurance document management system. By utilizing such a system, insurance companies can ensure that confidential data, such as customer details and policy information, is safeguarded against unauthorized access. Implementing restricted access controls allows only authorized personnel to view, edit, or share sensitive documents, reducing the risk of data breaches and maintaining compliance with privacy regulations. This heightened level of security instills trust among customers and stakeholders, reinforcing the integrity and reliability of the insurance company’s operations.

Facilitates compliance adherence by maintaining and organizing necessary documentation.

An insurance document management system plays a crucial role in facilitating compliance adherence by meticulously maintaining and organizing all necessary documentation. By centralizing important documents related to insurance policies, claims, customer information, and regulatory requirements, insurance companies can ensure that they have easy access to the right information when needed. This proactive approach not only streamlines audits and regulatory inspections but also helps in demonstrating a commitment to upholding industry standards and legal obligations. The system’s ability to efficiently manage and track documentation ensures that insurers are well-prepared to meet compliance requirements, thereby reducing the risk of penalties and improving overall operational integrity.

Cost savings by reducing expenses related to printing and storing physical documents.

One significant advantage of implementing an insurance document management system is the cost savings it offers by reducing expenses associated with printing and storing physical documents. By digitizing and centralizing insurance documents, companies can eliminate the need for paper-based processes, thus cutting down on printing costs, storage space requirements, and maintenance expenses. This streamlined approach not only saves money in the long run but also contributes to a more environmentally friendly and sustainable business operation.

Better customer service through quick retrieval of customer information for inquiries and claims processing.

An insurance document management system offers the significant advantage of enhancing customer service by enabling quick retrieval of customer information for inquiries and claims processing. With all relevant documents stored in a centralized digital database, insurance agents can promptly access necessary details, such as policy information and claim history, to provide timely and accurate responses to customer inquiries. This streamlined process not only improves overall customer satisfaction but also expedites claims processing, leading to a more efficient and positive experience for policyholders.

Initial Implementation Costs

One notable drawback of implementing an insurance document management system is the initial cost involved. Establishing such a system necessitates a substantial upfront investment in software, hardware, and training. This financial commitment can pose a challenge for insurance companies, especially smaller ones with limited budgets. The need to allocate resources towards acquiring and implementing the necessary technology may deter some organizations from embracing these systems despite their long-term benefits.

Integration Challenges

Integration Challenges: One significant drawback of implementing an insurance document management system is the potential for integration challenges. Incorporating the new system into the existing software and workflows within the organization can lead to technical complexities and temporary disruptions in operations. Ensuring seamless compatibility and data transfer between systems may require extensive planning, testing, and adjustments, which could impact productivity during the transition period. Effective communication and collaboration among IT teams and stakeholders are essential to navigate these integration challenges successfully.

User Resistance

User Resistance can pose a significant con when implementing an insurance document management system. Employees who are accustomed to traditional paper-based processes may face challenges and exhibit reluctance in transitioning to a digital system. This resistance can hinder the adoption of the new system, leading to delays in implementation and potentially impacting overall efficiency. Overcoming user resistance through proper training, clear communication of benefits, and addressing concerns is crucial to successfully integrating an insurance document management system into the workflow of an organization.

Maintenance Complexity

The con of maintenance complexity associated with an insurance document management system can pose challenges for organizations. Ongoing upkeep and updates of the system often demand specialized IT support, leading to increased complexity and time investment. Addressing technical issues, ensuring system compatibility with evolving technologies, and managing software updates can strain resources and hinder operational efficiency. The need for dedicated IT support to navigate these complexities underscores the importance of considering the long-term maintenance requirements when implementing such a system.